In addition, demand for oil has been reduced by now longstanding greener alternatives and gas mileage reduction in our vehicles. Our lower dependence on foreign oil has forced producers who once sold to the US to compete on price with an increasing number of suppliers in Asian markets, as well. On the supply side, fracking has increased US oil production to nearly 9 million barrels a day, and domestic crude oil reserves hit 36 billion barrels in 2013 for the first time since 1975 (source: US Energy Information Administration).

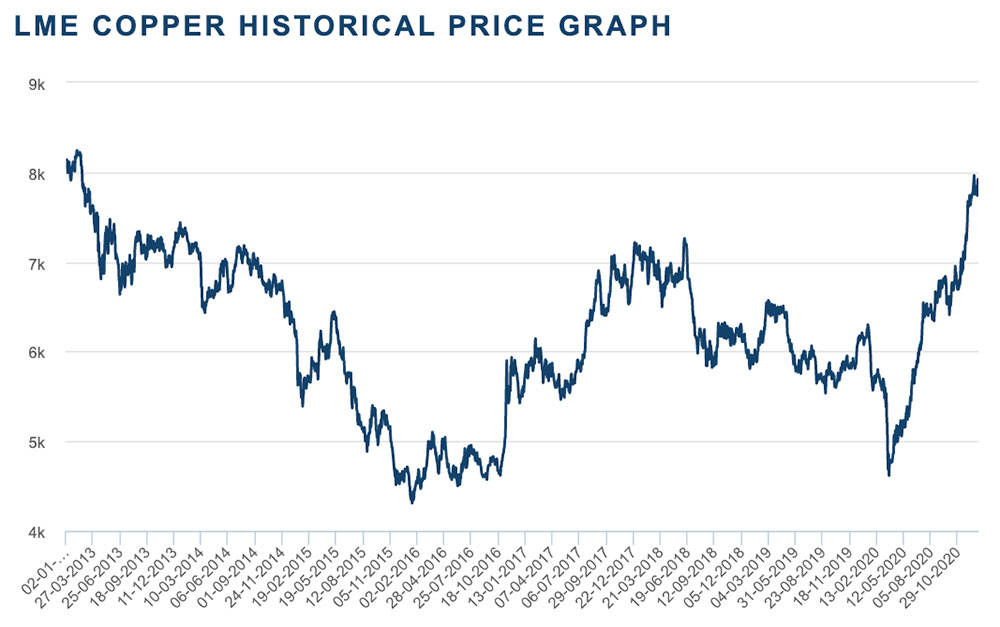

Long-term, as the price of oil fluctuates, so has the price of copper.Īccording to Darren Gaudreault, Admiral’s Vice President of Purchasing, “There are economic drivers indicating the correlation between copper and oil prices may be weakening over time.” While global economic factors continue to connect them, there are separate influencers affecting each commodity’s supply and demand. In addition, energy costs comprise about 30 of the smelting and refining process. Oil and copper tend to be affected by the same economic factors. Historically, the price of copper has been strongly correlated with the price of gold, the Chinese economy, world trade, and most consistently, with the price of oil.

In general, rising copper prices have indicated strong demand and global economic strength lower prices, a weaker economy. More than any other base metal, copper is tied closely to manufacturing, electrical engineering, industrial production, information technology, construction, and the medical sector. Copper has long been considered a leading indicator of global economic health.

0 kommentar(er)

0 kommentar(er)